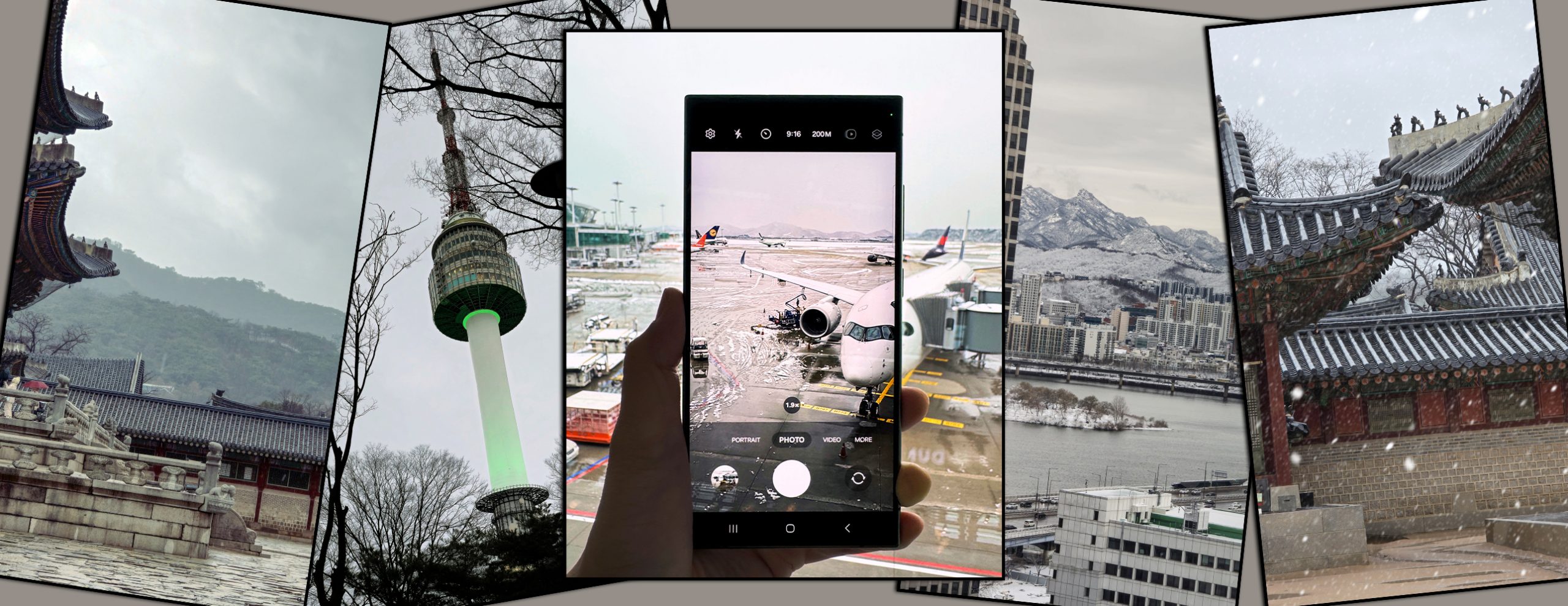

Traveling is already complicated enough as it is, and paying in foreign currencies is always a headache. With ridiculous bank fees and unpredictable exchange rates, you find out how much you really paid only when your bank statement arrives. And BOOM, now you gotta eat grass for the next 2 months.

Introducing to you your new travel best friend: YouTrip. The YouTrip wallet is the brainchild of EZ-Link, You Technologies and Mastercard, and you can use it to pay in up to 150 different currencies without any transaction fees or currency charges.

The only thing that you’re paying for is the conversion fee when you exchange different currencies, which YouTrip calculates per minute based on wholesale exchange rates. Even then, you’ll still be able to avoid extra charges and the jacked-up bank rates when you pay with your normal credit card. It might not seem like a lot, but if you’re making a lot of purchases using the card when you’re traveling or shop online a lot, you can end up saving money in the long run.

Every account comes with a free linked Mastercard which you use to make the purchases, and there is no minimum account balance.

Use the YouTrip app to view your e-wallet and balances, which are updated in real-time. You can also use the app to deactivate the Mastercard if you lose it. Just be careful not to lose your phone since its also your wallet!

Just in case you’re a bit confused, Youtrip put together a little comparison chart.

Youtrip also doubles up as an e-wallet. For now, only 10 currencies can be stored in the card, up to a maximum value of SGD$3,000. YouTrip converts currencies by the minute, so you can monitor the rates and quickly convert cash without having to make a trip to the money changer when the rates are good.

These 10 currencies include:

– Singapore Dollar (SGD)

– Japanese Yen (YEN)

– Hong Kong Dollar (HKD)

– New Zealand Dollar (NZD)

– Australian Dollar (AUD)

– US Dollar (USD)

– Euro (EUR)

– Swedish Krona (SEK)

– British Pound (GBP)

– Swiss Franc (CHF)

Here’s an example on how to make full use of your e-wallet: If you’re traveling to Hong Kong soon, you can monitor exchange rates and store the HKD in your wallet. Use your Mastercard when you’re in Hong Kong without paying any extra fees!

Stuck overseas and running out of money? Use the Youtrip card to withdraw cash at any Mastercard, Maestro or Cirrus ATMs. A withdrawal fee of $5 or foreign currency equivalent will apply, but you won’t be subjected to the crazy exchange rates offered by banks. Of course, you can just pay with your card!

The YouTrip card can also double up as an MRT card when you’re traveling around Singapore too! What an amazing card.

Sign up for a free YouTrip account here. Download the app on both App Store and Google Play now.

If you still insist on using your credit card for purchases, check out our post on the best credit cards to rack up miles.

You must be logged in to post a comment.